Irrevocable Life Insurance Trust

With the ever-changing landscape of taxes, it is growing increasingly difficult to understand how legislation affects clients and could possibly impact their financial future. As a leader in the financial services industry for the past 30 years, we get it. That’s why HD Vest Financial Services® is constantly seeking ways to share the latest knowledge we acquire with you. We’ve created the Taxes & Investments: Timely and Timeless Strategies Series to share timely information and provide our Advisors and their clients with practical information and ideas they can build on.

What is an Irrevocable Life Insurance Trust?

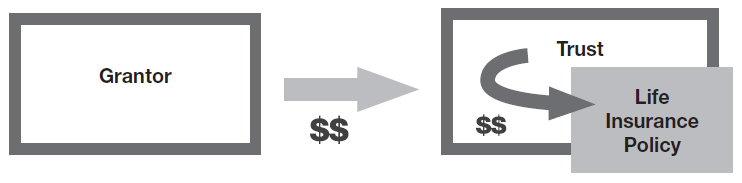

An Irrevocable Life Insurance Trust (ILIT) is an estate planning tool used by individuals (grantors) and families to irrevocably (not possible to revoke) gift their annual gifting exclusion and/or their lifetime gifting exclusion value to a trust that then funds a life insurance policy on the grantor1. This effectively removes life insurance proceeds from the grantor’s estate2. When structured properly, an ILIT is a powerful legacy and estate tax planning tool.

Why would I use one?

There are many reasons an individual would consider using an ILIT as part of their overall legacy and estate tax plan:

Create Liquidity - ILITs create liquidity for the beneficiaries of estates that hold large amounts of illiquid assets, i.e. real estate, business interests, etc… This allows the beneficiary(ies) the flexibility to pay debts and taxes due without liquidating the assets.

Leveraging the Generation-Skipping Transfer Tax Exemption - The generation-skipping transfer tax limits the amount a taxpayer can gift to a grandchild or to individuals removed by two or more generations without paying tax3. An ILIT allows a taxpayer to gift up to the maximum limit and then purchase life insurance to leverage the amount of money left to their beneficiaries. The value of the trust could be made available at the grantor’s death to the grantor’s grandchildren or great-grandchildren without owing generation-skipping tax.

Control - When assets are placed into an ILIT the grantor through the trust can control when or if the beneficiary(ies) receive a distribution from the trust. Restrictions can be placed on the trust to force good behavior or even to achieve certain milestones before the beneficiaries receive any of the proceeds. At the grantor’s discretion the trust can be designed by their attorney to control or limit distributions based on pre-defined criteria.

How does it work?

This strategy works when a taxpayer uses their annual and/or lifetime gifting exclusions to irrevocably gift assets to a trust. The grantor is allowed to gift their annual gifting exclusion amount multiplied by the number of beneficiaries of the trust. In addition to that, the grantor can also gift their lifetime gifting exclusion3. For example, Bob wants to gift money to his ILIT that has 3 listed beneficiaries:

Total Allowable Gift = (Annual Gifting Exclusion x 3) + Lifetime Gifting Exclusion

In order to use the annual gifting exclusion (not the lifetime exclusion) to contribute to an ILIT, the trustee of the trust will have to give the beneficiary(ies) the option, in writing, to take their portion of the annual gift from the trust. The beneficiary(ies) must be given 30 days to withdraw the assets3. Once the 30 day period has passed (if necessary), the trustee will then use those annual and/or one time gifts to buy a life insurance policy on the grantor’s life. This policy will be owned by the trust.

When the grantor dies, the life insurance policy will distribute assets to the trust which will be held outside of the grantor’s estate3.

The Irrevocable Life Insurance Trust (ILIT) can be a highly effective estate tax and legacy planning tool. When structured correctly, it can provide an individual a way to create liquidity for their heirs without adding additional assets to their estate. Because ILITs are a complex financial tool, it is important to contact your HD Vest Advisor to see if an ILIT is a suitable strategy in your overall legacy plan. HD Vest Advisors are unique in that they familiar with the tax, investment and insurance aspects of an ILIT and can help structure them appropriately.