The Power of Dollar-Cost Averaging

With the ever-changing landscape of taxes, it is growing increasingly difficult to understand how legislation affects clients and could possibly impact their financial future. As a leader in the financial services industry for over 30 years, we get it. That's why HD Vest Financial Services® is constantly seeking ways to share the latest knowledge we acquire with you. We've created the Taxes & Investments: Timely and Timeless Strategies series to share timely information and provide our Advisors and their clients with practical information and ideas they can build on.

Dollar-cost averaging can be a very powerful tool for investors. It is simply investing the same dollar amount into the market at a specified time interval. For example, $100 per month in investment XYZ for ten months. By using the dollar-cost averaging strategy, an investor can take advantage of market volatility to increase the number of shares they purchase.

An example of this principal is a farmer who would like to buy sheep for his farm. The farmer has $500 to invest in sheep that are currently selling in the marketplace for $100 each. If the farmer buys all of the sheep he can afford today, he will purchase five sheep total for an average price of $100:

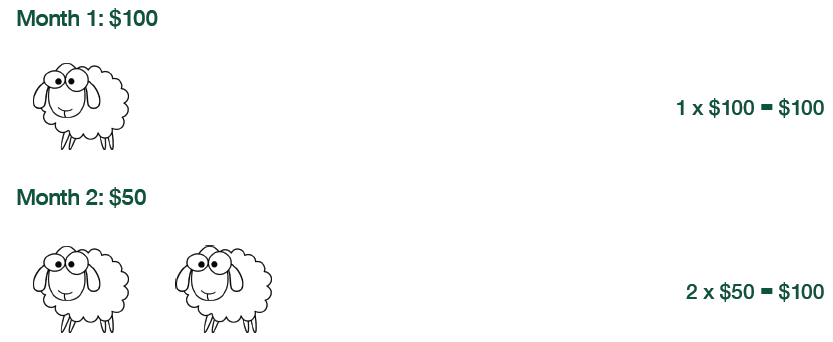

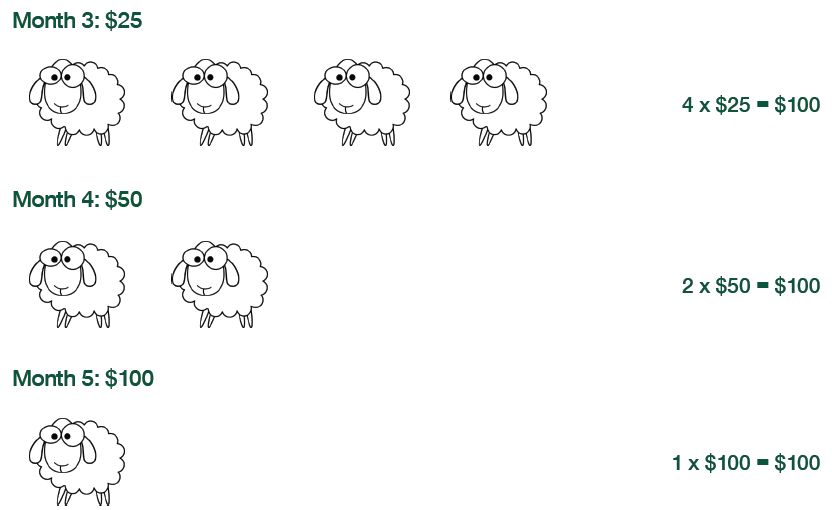

Let's say that the same farmer feels that the market price of sheep may be volatile in the short term, and that he wants to purchase the sheep over time instead. He decides to buy $100 worth of sheep per month for the next five months. The price of sheep does the following:

With the dollar-cost averaging method, the same $500 was able to purchase a total of ten sheep at an average price of $50 per sheep because the farmer took advantage of the volatility in the market.

Dollar-cost averaging over several market cycles could possibly tip the scales in the investor's favor over time. By being disciplined in the investment process with dollar-cost averaging, individuals may end up with more shares over time and thus may be in a better financial position than they would be otherwise. An HD Vest Advisor can help implement the dollar-cost averaging process and advise what will work best to attain an investor's ultimate goals and objectives.