AIM WITH PRECISION

Managing Risk and Return

Breaking Down Complexity

How do you take a complex idea and create a plan that makes sense to you? Your HD Vest Advisor can work with you to alleviate some of the mystery and help you develop an understanding of some of the core principles of investing. Following a 3-Step Process will help you develop an investment plan that focuses on your long-term goals, accounts for your risk tolerance and creates a formula to avoid market timing and volatility, which helps you avoid chasing investment returns with little reward.

A Disciplined Approach to Long-Term Investing

Building and protecting what you have worked so hard to earn is critical to the pursuit of your goals, but it is nearly impossible to time the market and pursue returns successfully on your own. With the help of your HD Vest Advisor, you can apply the principles of a 3-Step Process that works to position your investments to capture more of what the markets have to offer. This process is always centered on your core goals, time horizon, risk tolerance, and planned outcomes.

The 3-Step Process: A Solid Foundation

This 3-Step Process, which implements the concepts of asset allocation, diversification1 and active rebalancing, is essential to the management of your wealth. Each concept is individually important, but by combining these three concepts, managing the overall risk and return of your investment portfolio is a constant priority.

Allocate

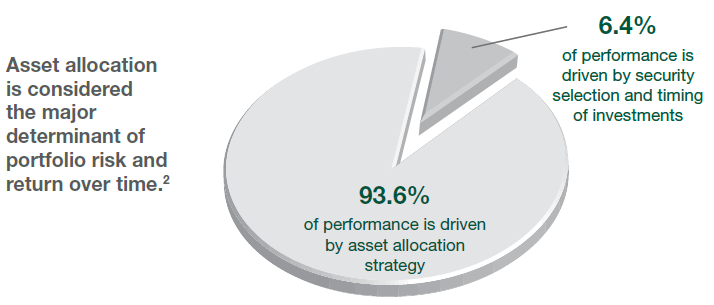

Asset allocation seeks to balance risk and reward by spreading assets across the three main asset classes—stocks, bonds and cash—to pursue the optimal returns for the risk level you are willing to undertake. Each asset class offers different levels of risk and return, and each is expected to behave differently over time. Asset allocation is one of the most important decisions that investors make.

Diversify

Diversification applies to the implementation of investments within each asset class. The rationale behind this concept is to limit the impact of an individual security by owning multiple securities within each asset class. This approach seeks to smooth out risk in a portfolio so that the positive performance of some securities will neutralize the negative performance of others.

Rebalance

Rebalancing realigns the weightings of your portfolio of assets, which can change due to market performance, distributions or contributions to your portfolio. Rebalancing involves periodically buying underweighted assets or selling overweighted assets in your portfolio to maintain your original desired asset allocation. This approach ensures your plan remains consistent with your risk tolerance and portfolio investment objectives.

Asset allocation and diversification do not assure or guarantee better performance and cannot eliminate the risk of investment losses.

Step 1 – Allocating Your Assets

Developing an investment strategy personalized to your needs and goals begins with asset allocation, the most fundamental and foundational component of portfolio management. Asset allocation means dividing assets among the various asset classes, such as stocks, bonds and cash or money market investments. Each asset class has associated risks as well as potential rewards that vary based on the anticipated level of exposure over time to market volatility, which is the degree to which returns vary within a given time period.

While there is no single investment product or asset class that eliminates all potential risks—even cash carries the potential risk of failing to outpace inflation over time—how assets are allocated within an investment portfolio has a profound impact on potentially reducing investment risk and pursuing more consistent returns. That’s because different asset classes tend to perform at different times. When one is up, the other may be down. The combination of asset classes may reduce portfolio volatility because of this differing behavior.

When considering your asset allocation, you and your HD Vest Advisor will discuss a more goal-oriented, balanced plan that focuses on your longer-term objectives rather than attempting to reap immediate short-term rewards. Your goals, time horizon and risk tolerance will all play an important role in determining your asset allocation approach.

While asset allocation enables portfolios to participate in a variety of market asset classes with the objective of minimizing volatility, asset allocation alone cannot ensure a profit or protect against loss.

Source: Gary P. Brinson, L. Randolph Hood, and Gilbert Beebower, "Determinants of Portfolio Performance," Financial Analysts Journal, January/February 1995.

Asset Allocation through Modern Portfolio Theory

A Disciplined Strategy

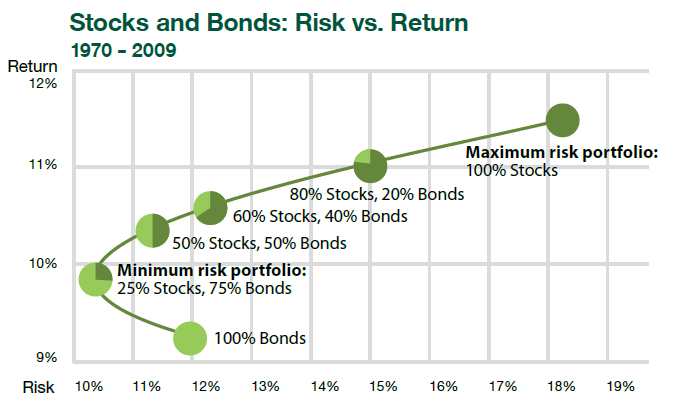

Asset allocation is a disciplined approach to portfolio management based on the concept of Modern Portfolio Theory. The developers of this theory, Harry Markowitz and William Sharpe, were awarded the Nobel Prize in Economic Science in 1990 for their contributions. Modern Portfolio Theory is a revolutionary view of portfolio investment that illustrates how investment risk may be reduced by spreading investments in specific proportions among different asset classes. This strategic approach to investment management is designed to help you invest while attempting to minimize risk associated with routine market fluctuations.

As the graph above illustrates, the combination of investments may have a more efficient risk and return profile than individual investments.

Past performance is no guarantee of future results. Risk and return are measured by standard deviation and arithmetic mean, respectively. This is for illustrative purposes only and not indicative of any investment. An investment cannot be made directly in an index. ©Morningstar, Inc. All Rights Reserved. 3/1/2010

Step 2 – Diversifying To Mitigate Market Volatility

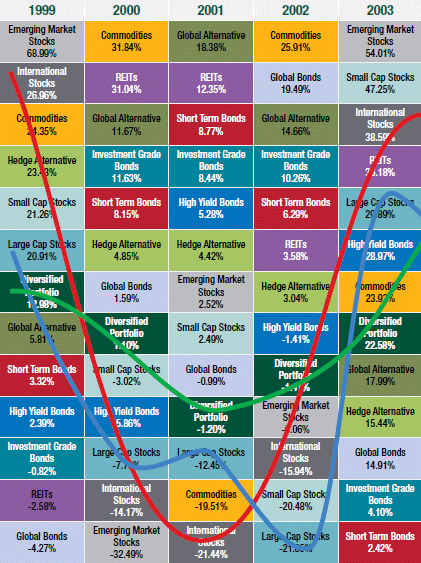

Because it is impossible to predict which markets will perform the best or when a market will change direction, asset allocation and diversification are important safeguards for your assets. By determining the appropriate asset allocation for you, you and your HD Vest Advisor establish desired characteristics for the investments that ultimately fill your portfolio. Applying diversification prevents the portfolio from becoming too concentrated in any one position, and investments with different investment objectives allow you to reap the benefits of different investment styles and market sectors.

Diversification seeks to moderate the volatility of market ups and downs. Diversification can be structured within asset classes—for instance, spreading your equity holdings among growth, value, small-, mid-, large-cap, and international equities—or it can occur across different asset classes, such as stocks and bonds. Specialty holdings such as real estate investment trusts (REITs) and commodities may also be considered in this mix.

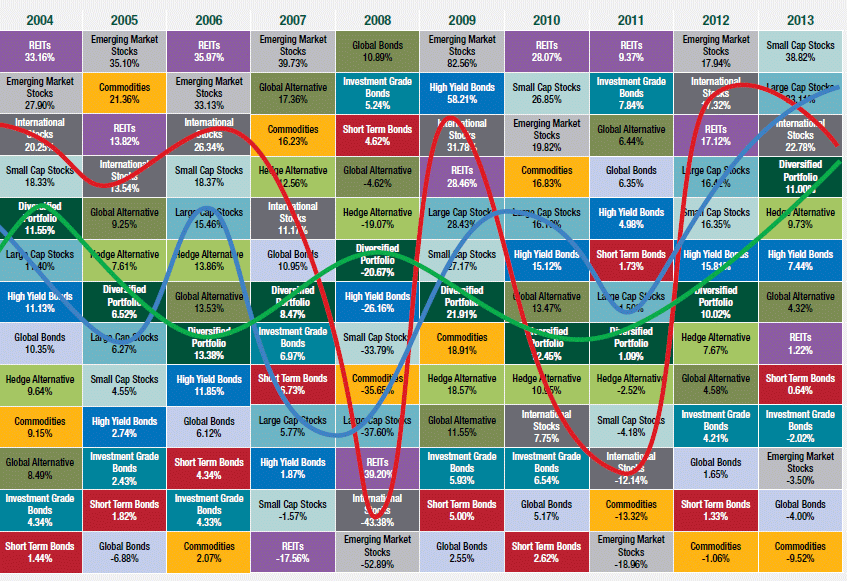

In the chart on the right, you can see how individual asset class performance rises and falls over time, displaying variable levels of volatility. Note that the sample Diversified Portfolio3 (green line) consistently performed near the middle of the asset class returns for this 15-year period, while returns of individual asset classes such as international stocks (red line) and large-cap domestic stocks (blue line) differed greatly from year to year. This illustrates how a diversified portfolio can reduce the volatility of individual asset classes while still generating reasonable returns. Importantly, smoothing this annual volatility helps you weather the emotional rollercoaster associated with investing and stay focused on your long-term plan instead of short-term market movements. A diversified portfolio means you are always in the right place at the right time.

Sample Diversified Portfolio is constructed using the weightings of our VestAdvisor Select® Global Conservative Growth with Alternatives model. Using the same index histories as the asset classes above, we blended the annual returns into the model weightings to create the Diversified Portfolio.

Step 3 – Rebalancing to Remain on Course

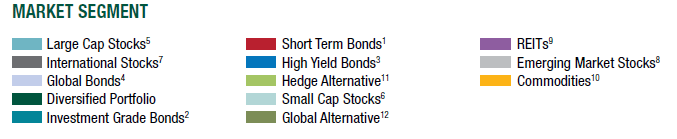

As the markets rise and fall, your asset allocation may shift with this movement, making your portfolio more conservative or more aggressive than what you initially intended. To keep your investments on track, a periodic review should be conducted in order to determine if rebalancing your portfolio needs to be completed to keep you on course with your stated objectives. If your investments have drifted too far from their targeted weightings, there may be a need to rebalance your portfolio by selling funds that have grown in value and buying more of those that have fallen in value. There is an added benefit of reducing the influence of emotion on investment decisions, as rebalancing seeks to manage the “balance” of your portfolios through the implementation of a disciplined strategy of buying low and selling high.

In the examples below, the actual market values of portfolios have changed as a result of market activity. One component of the portfolio has grown overweighted relative to the other component, leaving the portfolio out of balance.

To rebalance the portfolio, some of the assets in the overweighted asset class should be sold, and additional assets in the underweighted asset class should be purchased. This brings the portfolio back into balance.

3-Step Process – Three Examples

When you allocate, diversify and rebalance, you are adhering to a proven process based on a long-term investment strategy tailored to your goals, time horizon and risk tolerance.

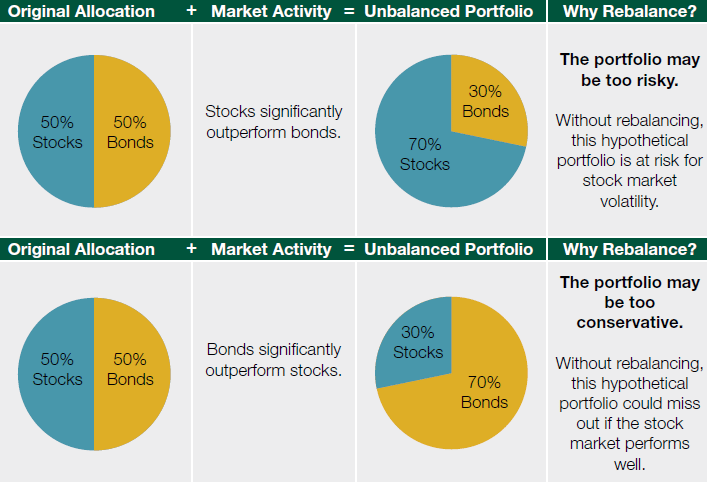

Below are three sample investment approaches representing the potential upside of following a 3-Step Process. Each hypothetical* investor funded a portfolio investing $2,500 each year over a 20-year period ($50,000 total from 1994 to 2013). Each one also follows a different investment strategy.

As you can see from the example below, the portfolio that followed the 3-Step Process of allocating, diversifying and rebalancing reaped the highest returns.

Hypothetical examples are for illustrative purposes only and are not intended to represent future performance of any specific products.

For purposes of this comparison, we used the S&P 500 index to represent equities and the Barclays U.S. Aggregate index to represent bonds. Portfolio 1 represents a $2,500 investment into the prior year’s worst performing asset class; the portfolio is never rebalanced. Portfolio 2 represents a $2,500 investment into the prior year’s best performing asset class; the portfolio is never rebalanced. Portfolio 3 represents a 60% investment into equities (S&P 500 index) and 40% investment into bonds (Barclays U.S. Aggregate index); every year, $1,500 is added to equities and $1,000 is added to bonds. At the same time, the existing portfolio is rebalanced to 60% equities and 40% bonds. The Barclays U.S. Aggregate Bond index measures the performance of investment grade bonds in the U.S. fixed-income universe. It includes U.S Treasury issues, agency issues, corporate bond issues and mortgage-backed issues. It is unmanaged, includes reinvestment of dividends, does not reflect the impact of transaction, manager or performance fees and is unavailable for investment. The Standard and Poor’s 500 is a capitalization weighted index of 500 leading companies in leading industries of the U.S. economy. It covers approximately 75% of the total capitalization of U.S. equities.

Index Performance sourced from Morningstar – © 2014 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Seek Experienced Advice and Get Started

Your HD Vest Advisor understands the full scope of your goals and overall financial picture, which equips him or her to work closely with you to determine the most appropriate approach to your long-term planning. Your HD Vest Advisor will start with a Risk Profile Questionnaire to help you both gain a deeper understanding of your objectives and then create a customized approach following the investment principles of the 3-Step Process.