The Case for Whole Life Insurance

Important Information

Distributions under a life insurance policy (including cash dividends and partial/full surrenders) are not subject to taxation up to the amount paid into the policy (cost basis). If the policy is a Modified Endowment Contract, policy loans and/or distributions are taxable to the extent of gain and are subject to a 10% tax penalty.

Access to cash values through borrowing or partial surrenders will reduce the policy’s cash value and death benefit, increase the chance the policy will lapse, and may result in a tax liability if the policy terminates before the death of the insured.

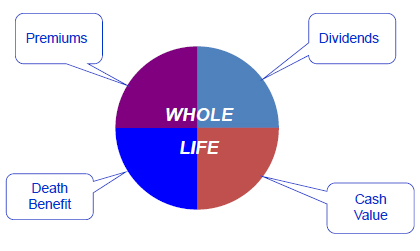

What is Participating Whole Life

Here are some basics…

- Permanent life insurance

- Provides lifetime coverage

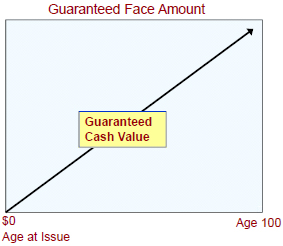

- Increasing guaranteed cash value designed to equal the policy face amount at age 100

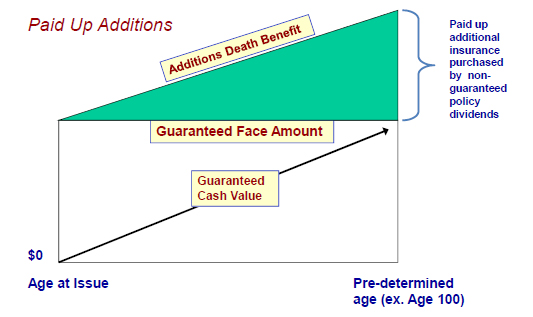

- “Participating” means policyholders are eligible to receive policy dividends, which are not guaranteed

The Advantages

Jorge and Maria are 40 years old. They have two children and just bought a new house. Why would they be interested in whole life insurance?

- Guaranteed Premiums

- Guaranteed Policy Death Benefit

- Living Benefits:

- Tax-deferred cash value accumulation

- Tax advantaged access to policy cash values (non-MEC)

- Policy Dividends (Not Guaranteed)

Policy Features

Let’s review… Whole life offers three guarantees. Circle the three features that are guaranteed in a whole life policy.

Guaranteed Level Premiums

- Premium is guaranteed and level

- Premium based on face amount of the policy, insured’s issue age, gender and underwriting issue class

- Policy riders can have a separate, additional premiums

- Contractual requirement to pay premium

- Premiums may be paid via non-guaranteed policy dividends, surrenders of paid-up additions or loans, if there is sufficient value in the policy to do so.

- No base policy premiums due after policy is paid up – but rider premiums may continue

Guaranteed Death Benefit

- The policy death benefit is level and contractually guaranteed

- Once the policy is paid-up the death benefit will remain in-force until death or surrender, assuming no policy loans are taken.

- The policy death benefit is net of any policy loans and accrued loan interest. For example…

Rick has a $500,000 face value whole life policy with $85,000 of cash value and an outstanding loan of $20,000, plus $5,000 of accrued loan interest. If Rick were to die today his widow would receive $475,000 of net death benefit.

Guaranteed Cash Value

- Guaranteed cash value is unique feature of whole life

- Policy contains a schedule of tabular annual guaranteed cash values

- Guaranteed cash values are based on a guaranteed interest rate and a guaranteed mortality table

Dividends

Sources of divisible surplus :

- Participating policyholders are eligible to receive an equitable share of “divisible surplus” each year as a policy dividend

- Dividends are NOT guaranteed.

- Divisible surplus is determined by Board of Directors each year

- Divisible surplus sources:

- Mortality savings

- Investment earnings

- Expense savings

The Contribution Principle

Dividend Options

- Cash to policy owner

- Reduce premiums

- Purchase paid up additional insurance

- Accumulate at interest

- Purchase additional oneyear term insurance

- Loan repayment

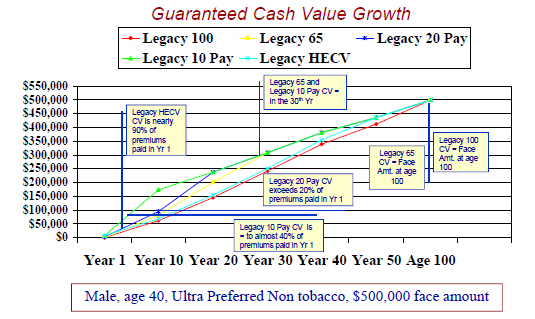

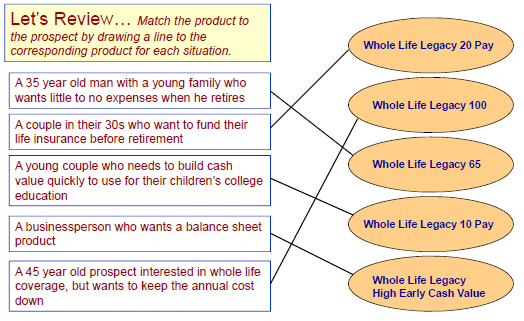

Whole Life Legacy Product Suite

- Whole Life Legacy 100

- Premiums payable to age 100

- Whole Life Legacy 65

- Premiums payable to age 65

- Whole Life Legacy 20 Pay

- Premiums payable for 20 years

- Whole Life Legacy 10 Pay

- Premiums payable for 10 years

- Whole Life Legacy High Early Cash Value

- Early guaranteed cash value growth

- Premiums payable to age 85

Premium Comparison

- Male - Age 40

- Ultra Preferred Non tobacco

- $500,000 Face Amount

| Product | Annual Premium | Paid Up |

|---|---|---|

| Legacy 100 | $7,070 | Age 100 |

| Legacy 65 | $9,845 | Age 65 |

| Legacy 20 Pay | $11,075 | 20 Years |

| Legacy 10 Pay | $16,975 | 10 Years |

| Legacy High Early Cash Value | $8,065 | Age 85 |

Whole Life Legacy Riders

- Waiver of Premium Rider (WP)

- Additional Life Insurance Rider (ALIR)

- Life Insurance Supplement Rider (LISR)

- Renewable Term Rider (RTR)*

- Guaranteed Insurability Rider (GIR)

- Accelerated Death Benefit Rider (ABR)

- Transfer of Insured Rider (TIR)

- Yearly Term Purchase Rider (YTP)

*Not available for qualified cases

Riders are available at an additional cost.

Summary

Today We Discussed:

- What is Participating Whole Life

- Permanent, lifetime coverage

- The Advantages

- Guaranteed premiums, death benefit, living benefits

- Policy Features

- Guaranteed cash values, dividend options

- Whole Life Legacy Product Suite

- Various products available

The Bottom Line Is

- Whole life provides you with permanent, lifetime coverage

- “Living benefits” through tax deferred accumulation of policy cash values; and tax advantaged access to policy cash values

- “Participating” whole life insurance gives the policy holder the potential to receive dividends, which are not guaranteed