529 Plans for College Savings

With the ever-changing landscape of taxes, it is growing increasingly difficult to understand how legislation affects clients and could possibly impact their financial future. As a leader in the financial services industry for over 30 years, we get it. That's why HD Vest Financial Services® is constantly seeking ways to share the latest knowledge we acquire with you. We've created the Taxes & Investments: Timely and Timeless Strategies Series to share timely information and provide our Advisors and their clients with practical information and ideas they can build on.

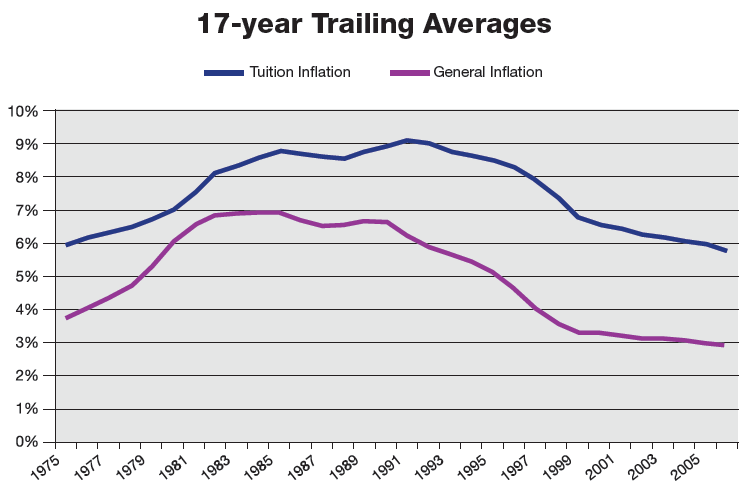

There is no doubt about it, college costs are on the rise. According to the College Board1, the average cost for tuition and fees at four-year public institutions has increased almost 51% over the last 10 years (after adjusting for inflation), and these costs are expected to continue going up. In fact, inflation on the cost of college has outpaced general inflation for the past 17 years2.

So how does one combat these price increases? Many parents have an unrealistic expectation that their children will receive merit-based financial aid. According to a survey by Bright Start College Savings3, 55% of parents believe their children will be eligible for some type of academic, sports or other type of scholarship. Unfortunately, just over 10% of college students receive such merit-based financial aid that does not need to be repaid, according to FinAid.org2.

Saving for college early can help with the increasing cost of a college education and help you be financially prepared when your children are ready for college. An effective way to save is to use a 529 plan.

What is a 529 Plan?

529 plans are a tax-advantaged investment plan designed to encourage saving for the future higher education expenses of a designated beneficiary (typically one's child or grandchild). The plans are named after Section 529 of the Internal Revenue Code and are administered by state agencies and organizations. Each state that offers a 529 plan determines how its plan is structured and which investment options are offered.

Why Use a 529 Plan?

529 plans offer many attractive benefits:

-

Federal Tax Benefits4 Assets inside of a 529 plan grow tax-deferred until they are withdrawn. The contributions to the plan are not federally tax deductible, but they can be withdrawn tax and penalty free as long as the funds are withdrawn for qualified education expenses. These include:

-

Tuition and mandatory fees

- Books, supplies, and equipment (only if the fees and expenses must be paid to the institution as a condition of enrollment or attendance)

- The full cost of room and board (if the housing is owned or operated by the college and if the student is at least half-time.) Off-campus housing costs can qualify up to the allowance for room and board that the college includes in its cost of attendance for federal financial-aid purposes (the college financial-aid office can give you that figure)

- Certain expenses for a special-needs student

- State tax benefits5 - Some states may offer tax breaks such as an upfront deduction for contributions or income exemption on withdrawals in addition to the federal treatment.

- Beneficiaries can be changed - The owner can change the beneficiary if they so desire. For example: if one child does not go to college or does not use the entire amount of their 529 plan, the owner could change the beneficiary to another child or even a grandchild (possibly subject to gift tax or generation skipping tax).

- Owner retains control of the assets - 529 plans are not considered the assets of the beneficiary, thus the owner keeps control over the assets. This means that if the beneficiary does not go to college the owner could cash out the plan if they did not want to change the beneficiary. (Note that earnings are subject to income tax and a 10% penalty.)

- Substantial deposits allowed5 - Many states allow for substantial contributions to 529 plans - in most states, over $300,000 per beneficiary (gift tax may apply). 529 plans also allow for accelerated gifting, meaning any donor can deposit five years' worth of annual exemption gifts into the plan in a single year as long as they do not make additional contributions or gifts to that beneficiary for the next five years. This is especially beneficial to parents or grandparents who need to remove assets from their taxable estate.

- Withdrawals are allowed penalty free if the beneficiary receives a scholarship5 - The IRS allows penalty-free withdrawals from a 529 plan up to the amount of qualified education expenses for the academic year. Income tax on the earnings will still apply.

- Tuition and mandatory fees

- Books, supplies, and equipment (only if the fees and expenses must be paid to the institution as a condition of enrollment or attendance)

- The full cost of room and board (if the housing is owned or operated by the college and if the student is at least half-time.) Off-campus housing costs can qualify up to the allowance for room and board that the college includes in its cost of attendance for federal financial-aid purposes (the college financial-aid office can give you that figure)

- Certain expenses for a special-needs student

Saving early for college expenses is very important. With the tax-deferred benefits of a 529 plan it is possible for invested assets to grow faster than if they were simply invested in a non tax-deferred account. The earlier you start a 529 plan, the more it will grow and the more money will be available to pay for qualified education expenses. Your HD Vest Advisor is available to help you determine the appropriate amount to save and which 529 plan makes the most sense for you.