Buy-Sell Agreements Using Life Insurance

With the ever-changing landscape of taxes, it is growing increasingly difficult to understand how legislation affects clients and could possibly impact their financial future. As a leader in the financial services industry for over 30 years, we get it. That's why HD Vest Financial Services® is constantly seeking ways to share the latest knowledge we acquire with you. We've created the Taxes & Investments: Timely and Timeless Strategies series to share timely information and provide our Advisors and their clients with practical information and ideas they can build on.

A major concern for many owners of a closely-held business is what will happen to the business if one of the owners passes away. A buy-sell agreement is an efficient way to transfer the ownership of a business and provide peace of mind for the owners. This strategy is also beneficial to the heirs, because they do not have to worry about selling the business. Without a plan in place, it is possible that the survivors would have to sell the business interest for far less than its value to pay the tax due on the decedent's estate.

The strategy works by drafting a legal document that will ensure that the other owners of the business or the company itself will purchase the deceased owner’s interest from his or her heirs.1 The agreement also requires that the heirs sell the business. Unless the purchaser(s) have sufficient cash on hand, the transaction is usually completed by utilizing a life insurance policy.

There are two ways a buy-sell insurance agreement can be structured: cross purchase and entity purchase.

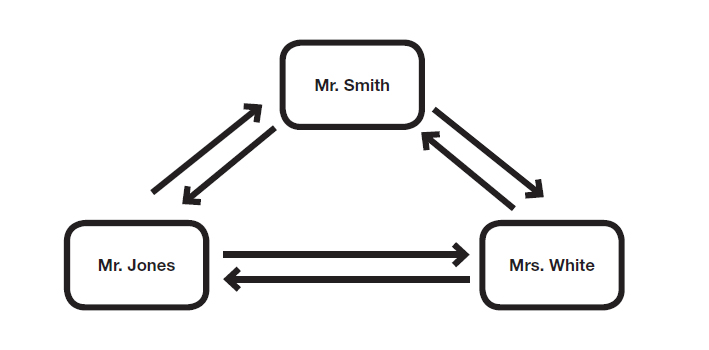

Cross Purchase

A cross purchase structure requires each of the owners to purchase a portion of the deceased owner's interest in the company. This strategy is most frequently used if there are fewer owners. The more owners, the more insurance policies required. For example, Mr. Smith, Mr. Jones and Mrs. White are all 1/3 owners of a business valued at $1.5 million. They want to protect the business so that in the event one of them passes away, the other owners would then purchase the decedent's 1/3 business interest from his or her respective heirs. This would leave the surviving owners with half of the business interest each after the purchase.

In a cross purchase plan, each owner would buy a $250,000 policy on the other two owners' lives so that the heirs would be paid a total of $500,000 ($250,000 from each of the surviving owners to total the deceased owner's interest). In our example, a total of six policies must be purchased.

Advantages of Cross Purchase:

- The owners can designate the percentage of ownership acquired.

- The buyers get an increased cost basis on the interest they purchase, which can reduce taxes due on a future sale of their business interest

- The individuals can pay the premiums if the business is in a higher tax bracket

- Insurance premiums can be paid for with an increase in salary to the buyer.

- The funding is not subject to the claims of the business creditors.

Disadvantages of Cross Purchase:

- Setup is more complicated if there are multiple owners, which would require multiple policies

- If one owner is unhealthy, the premiums on that individual may be significantly higher than the premiums on the other owners.

- There are less tax savings if the owners are in a higher tax bracket than the business

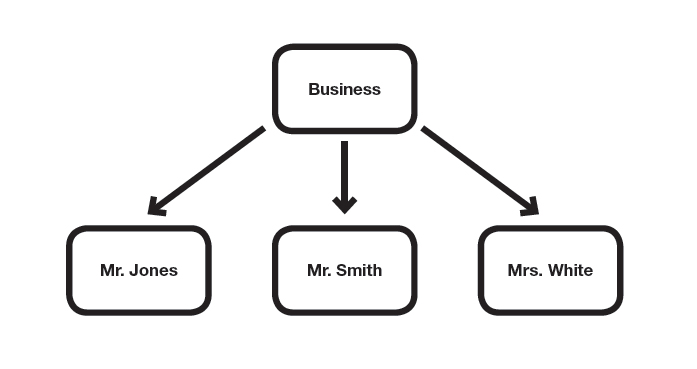

Entity Purchase

An entity purchase structure requires the company to purchase the deceased owner's interest in the business. A life insurance policy on each of the owners is then purchased by the business. An entity purchase structure is most frequently used if there are many owners of the business, or if one owner is in significantly worse health than the other owners. In our example, the business would buy one $500,000 life insurance policy on Mr. Smith, Mr. Jones and Mrs. White.

Advantages of Entity Purchase:

- The business, not the individual owners, pays for the insurance policies.

- It is much easier to administer because only one policy per owner is required.

- There is a greater tax advantage if the owners are in a higher tax bracket than the business

- There is a greater advantage to the individual owners if one owner is in poorer health than the

others.

Disadvantages of Entity Purchase:

- The funding of the agreement is subject to the creditors of the business

- It does not allow owners to designate the percentage of ownership—there may be an unintentional shift of control.

- Stock attribution rules may cause the payment from the business to the estate to be taxed as a dividend instead of a capital gain.

- It may cause problems with the corporate accumulated earnings tax.

- The cost basis does not increase for current owners of a C corporation

- The tax advantage diminishes if the owners are in lower tax bracket than the business

- The corporate cash values and death benefit may be subject to alternative minimum tax

Establishing a buy-sell agreement can assure owners of a closely-held business that their interest in the business they worked hard to build is secure, regardless of any unforeseen circumstances. An HD Vest Advisor can help determine which strategy, cross purchase or entity purchase, is best for the buy-sell agreement and advise each owner regarding his or her individual interests.