WILL YOUR RETIREMENT

PLAN RETIRE WITH YOU?

UNDERSTANDING YOUR RETIREMENT PLAN OPTIONS

Is Your Employer Retirement Plan Working for You?

Whether you’re changing jobs or retiring, knowing what to do with your hard-earned retirement plan savings can be difficult. An employer-sponsored plan, such as a 401(k), may make up the majority of your retirement savings, but how much do you really know about that plan and how it works? Compounding the decision-making difficulty of what to do with your retirement savings are the seemingly endless rules that vary from one retirement plan to the next.

Maximizing your savings and minimizing taxes is the key to a successful retirement plan spending strategy. Your HD Vest Advisor can help you understand how your retirement savings plan fits into your overall financial picture and how to make that plan work for you.

Retirement Plan Distributions: Know Your Options

By age 40, baby boomers have worked an average of 11 jobs; for millennials, that number may be even higher.2 What that means is, with every new job, many of today’s workers are faced with the choice of what to do with their retirement savings plans from their former employer.

Generally, you have four retirement plan distribution options:

- Roll over your money into an Individual Retirement Account (IRA)

- Keep your savings in your former employer’s plan, if allowed

- Transfer your assets into your new employer’s plan, if allowed

- Take a lump-sum distribution

With each option, there are factors to consider in terms of investment choices, expenses, services offered and more. The purpose of this guide is to educate you on the options generally available for your retirement plan so that you can make informed investment decisions.

Roll Over Your Money into an IRA

Choosing an IRA rollover means that your money remains tax-advantaged and capable of growth, as in your employer-sponsored plan, but you may also gain more investment options than what may have been available in your employer-sponsored plan. You may also gain oversight of managing these important retirement assets from your trusted Advisor.

If you roll your retirement plan assets over into an IRA account that you already own through your HD Vest Advisor, you also receive the benefit of combined statements and holistic investment planning, making it easier to track your overall financial situation.

Benefits

- Tax-deferred growth potential

- Generally avoids current income tax and distribution penalties when removed from employer-sponsored retirement plan4

- More investment choices

- Allows for additional contributions, if eligible

- IRAs can be combined and handled by one provider, thereby reducing trustee costs and consolidating statements

- Protection from creditors in federal bankruptcy proceedings5

- Combined amount of your required minimum distributions (RMDs) can be taken from any of your Traditional, SEP or SIMPLE IRAs

Considerations

- Internal management fees are generally higher than in an employer-sponsored retirement plan

- Fees and expenses depend largely on the investments you choose

- Loans from an IRA are not allowed

- Early distributions may be subject to 10% IRS tax penalty in addition to income tax4

- RMDs begin April 1 following the year you reach 70½ and annually thereafter; leaving the money in the former employer plan may allow RMDs to be delayed until separation from service

- IRAs are subject to state laws governing malpractice, divorce, creditors (outside of bankruptcy), and other lawsuits; leaving the money in the former employer plan may provide additional protection against creditors

- Net unrealized appreciation (NUA) is the difference between what you paid for employer securities and their increased value. You lose favorable tax treatment of NUA if the funds are rolled into an IRA

The type of IRA you choose depends on the type of account you have now, when you want to pay taxes and other factors. To learn more about the various types of personal IRAs—Traditional, Roth and Rollover—ask your HD Vest Advisor for a copy of “Protect Your Nest Egg: Maximize Savings and Minimize Taxes with an IRA.”

Approximately 95% of money contributed to traditional IRAs is from rollovers, primarily from employer-sponsored retirement plans. Of the four options, rolling your assets into an IRA is by far the most popular.6

Keep Your Savings in Your Former Employer’s Plan

If you change jobs, you may be permitted to leave your retirement savings invested in your former employer’s plan. This allows your savings to retain tax-advantaged growth potential, but keeping track of multiple retirement accounts in different locations may prove difficult over time. Additionally, you are still bound by the plan’s rules and restrictions on investments, and the plan may place additional restrictions on accounts for former employees. Your HD Vest Advisor can help you decide whether this option may be suitable for you.

Benefits

- No immediate action required by you

- Tax-deferred growth

- Able to keep current investments

- Fees and expenses are generally lower in an employer-sponsored retirement plan than an IRA

- Avoidance of 10% IRS tax penalty on plan distributions if you separate from service at age 55 or older (50 or older for certain public safety workers)4

- Potential protection from creditors in federal bankruptcy proceedings under Employee Retirement Income Security Act (ERISA)5

- Net unrealized appreciation (NUA) is the difference between what you paid for employer securities and their increased value. Favorable tax treatment of NUA if applicable

Considerations

- Former employer may enforce restrictions on former employee accounts

- New employer may not allow you to rollover your former employer’s plan into the new employer’s plan

- Loans may become due upon separation from service

- Additional contributions typically not allowed

- Early distributions may be subject to 10% IRS tax penalty in addition to income tax4

- RMDs begin April 1 following the year you reach 70½ and annually thereafter; leaving the money in the former employer plan may allow RMDs to be delayed until separation from service

- Aggregation of RMDs is not allowed in employer-sponsored plans; RMDs must be taken from each plan separately

- Not all employer-sponsored plans have bankruptcy protection under ERISA5

Transfer Your Assets into Your New Employer’s Plan

If you are entitled to receive benefits at your new place of employment, you may have access to an employer-sponsored retirement plan. If you would like to have your retirement plan accounts in one place, you may choose to move your existing retirement plan account to your new employer’s plan. This option is similar to leaving your assets with your former employer, but it has the added benefit of consolidation; however, if your former plan had better investment choices or net unrealized appreciation (NUA) of employer stock, it may be better to leave the assets where they are. Your HD Vest Advisor can help you decide whether this option is appropriate for you and your needs.

Benefits

- Tax-deferred growth potential

- Internal management fees and expenses are generally lower in an employersponsored retirement plan than an IRA

- Avoidance of 10% IRS tax penalty on plan distributions if you separate from service at age 55 or older (50 or older for certain public safety workers)4

- RMDs begin April 1 following the year you reach 70½ and annually thereafter; leaving the money in the new employer plan may allow RMDs to be delayed until separation from service

- Protection under ERISA from creditors in federal bankruptcy proceedings5

- Retirement assets from former and new employer can be combined into one plan

- Loans may be allowed

Considerations

- Eligibility determined by new employer

- Paperwork required for moving assets may be extensive and difficult

- Type of rollover assets allowed may be restricted by plan

- May have a waiting period before enrollment is allowed

- Investment options limited to those chosen by plan sponsor

- New plan determines how and when you access your savings

- Net unrealized appreciation (NUA) is the difference between what you paid for employer securities and their increased value. Favorable tax treatment of NUA is lost when assets are moved to a new plan

Take a Lump-Sum Distribution

The impact of cashing out your retirement savings depends largely on your age and tax situation; significant tax consequences and penalties may apply if you withdraw the funds early. Your HD Vest Advisor can help you consider all of the financial consequences of this option.

Benefits

- Immediate access to your retirement savings, which you can use however you wish

- Avoidance of 10% IRS tax penalty on plan distributions if you separate from service at age 55 or older (50 or older for certain public safety workers)4

- Lump-sum distribution may qualify for favorable tax treatment of net unrealized appreciation (NUA), if applicable. NUA is the difference between what you paid for employer securities and their increased value

Considerations

- Funds lose tax-deferred growth potential

- Distribution may be subject to federal, state and local taxes unless rolled into an IRA or employer plan within 60 days

- May owe 10% IRS tax penalty on plan distributions if you leave your employer before age 55 or older (50 or older for certain public safety workers)4

- Former employer is required to withhold 20% for the IRS

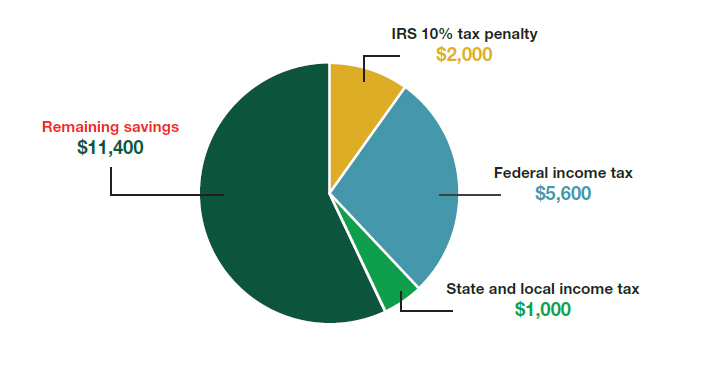

Depending on your financial situation, a lump-sum distribution can be costly. For example, a little over half of the assets remain after an early distribution of $20,000.9

Seek Experienced Advice

Your HD Vest Advisor understands the importance of your retirement savings to your overall financial well-being. He or she is prepared to help you find retirement solutions or work with those you already have to keep you financially healthy. Whether you are one year or 20 years from retirement, or even if you don’t have any plans to retire, your HD Vest Advisor can help you find a solution that fits what you need.

If you already have a strategy in place, your Advisor can do a cost/benefit analysis to ensure it is the best fit for your goals. Your Advisor knows the full scope of your financial picture, which makes him or her more than equipped to address your retirement needs. Plus, our Advisors are backed by HD Vest Retirement Specialists who provide specialized support to ensure you are paired with the best solutions possible.